BCO® Branch Compliance Officer Exam Study Tools

BCO®

BCO® Online Study Tools

180 Days (6 months) Online Access

- Online Study Guide

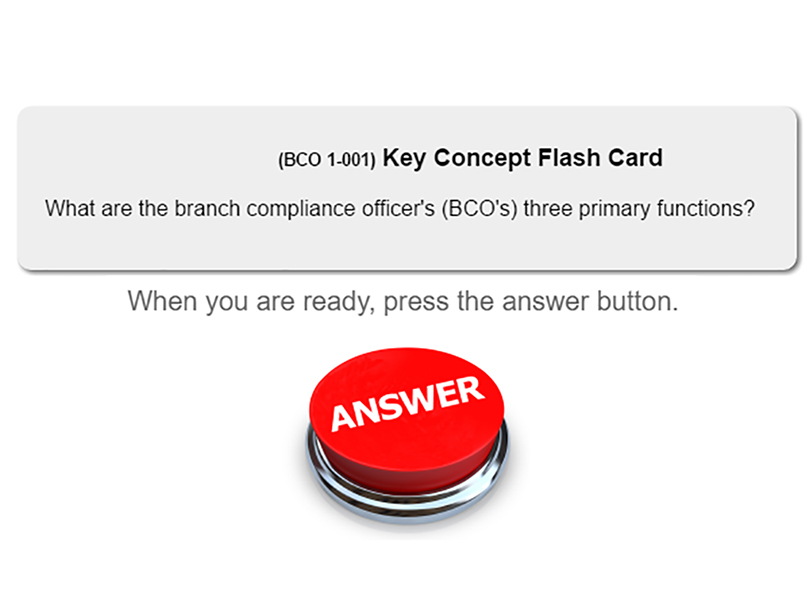

- Online Flash Cards

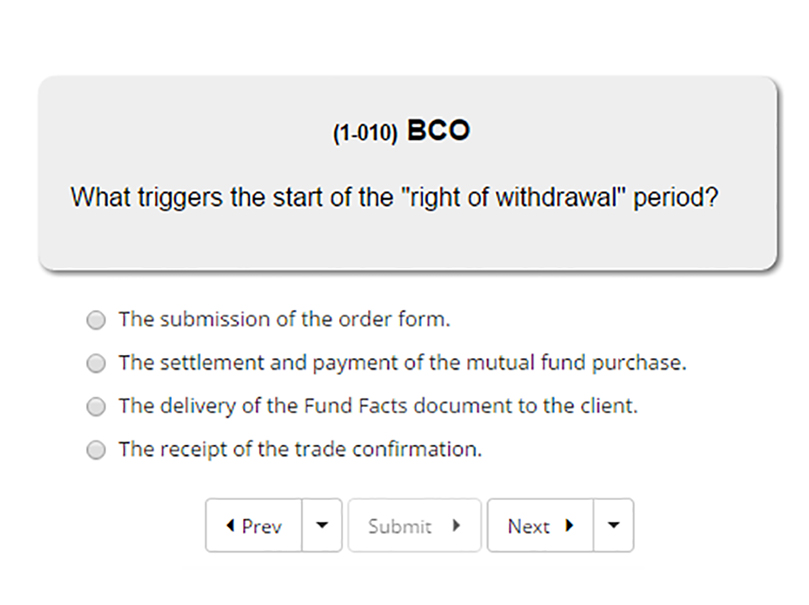

- Online Quizzes

- Online Practice Exams

- Money Back Guarantee

Your SeeWhy Learning study centre was created for a single user and is not transferable to, or to be shared by, another user, whether it is used for the full subscription time period or part thereof.

Your subscription is effectively designed for your sole use and not to be shared. Sharing access will result in termination of your subscription. Please read the full User Agreement.

Branch Compliance Officer (BCO) Exam Preparation and BCO® Study Notes

Successful completion of the "Branch Compliance Officer - BCO" course, as offered by CSI®, satisfies the educational requirement necessary to supervise Mutual Funds sales representatives based on the requirements of the MFDA for a Branch Manager. This designation qualifies the individual with the competencies to manage and oversee a financial institution's Mutual Funds dealings in an operating branch. Our study materials are designed to help you pass the BCO® exams, and do not constitute enrolment in the actual Branch Compliance Officer's Course (BCO) itself. Click here for more information on the CSI website page for the BCO course and exam.

Also available:

CIFC® IFIC® IFC® Mutual Funds Exam Preparation and Study Notes

Successful completion of the "Mutual Funds" course, as offered by both CSI®/ICB® (Investment Funds in Canada® ~ IFC®) and IFSE® (Canadian Investment Funds Course® ~ CIFC®), satisfies the educational requirement necessary to sell Mutual Funds in Canada, as set out by the Mutual Fund Dealers Association (MFDA®). Our study materials are designed to help you pass the IFIC exam, and do not constitute enrolment in the actual Mutual Funds course itself.

Canadian Securities Course® (CSC®) Exam Preparation and CSC® Study Notes

*Our CSC® Study Tools are in-line with the most current Updates

The Canadian Securities Course® (CSC®), as offered by the Canadian Securities Institute (CSI), is the initial course required for becoming licensed to sell securities, like stocks and bonds, in Canada, as set out by IIROC. The CSC® can also be used to satisfy the educational requirement necessary to sell mutual funds in Canada, as set out by the Mutual Fund Dealers Association (MFDA). Our study materials are designed to help you pass the CSC® exams, and do not constitute enrolment in the actual Canadian Securities Course® itself.

Derivatives Fundamentals and Options Licensing® (DFOL®) Exam Preparation and DFOL® Study Notes

The Derivatives Fundamentals and Options Licensing® (DFOL®) is offered by CSI Canadian Securities Institute and is a one-step course that satisfies both educational requirements for becoming licensed to advise and sell options to clients in Canada, as set out by IIROC. The SeeWhy study materials are designed to help you pass the DFOL® exam, and do not constitute enrolment in the actual Derivatives Fundamentals and Options Licensing® course itself.

The Derivatives Fundamentals and Options Licensing® (DFOL®) is really two courses that are merged together, the Derivatives Fundamentals Course® (DFC®) and the Options Licensing Course® (OLC®). The first textbook in the DFOL® program covers the DFC® material. The second textbook in the DFOL® program covers all of the OLC® material. The SeeWhy Learning study tools cover each chapter in the DFOL® textbooks and explain many difficult concepts in clear, easy to understand language along with examples. The DFOL® has an application-oriented exam that is not evenly weighted between the two textbooks and we strongly recommend anyone considering the DFOL® course look at working through many of the key concept explanations and exam-level questions that we offer as the exam is known to be quite challenging.

Options Licensing Course® (OLC®) Exam Preparation and OLC® Study Notes

The Options Licensing Course® (OLC®) is offered by CSI Canadian Securities Institute and satisfies the educational requirements for the second course to become licensed to advise and sell options to clients in Canada, as set out by IIROC. The OLC® is ideal for advisors that have already completed the Derivatives Fundamentals Course® (DFC®). The SeeWhy study materials are designed to help you pass the OLC® exam, and do not constitute enrolment in the actual Options Licensing Course® itself.

The SeeWhy Learning study tools cover each chapter in the OLC® textbook and explain many difficult concepts in clear, easy to understand language along with examples. The OLC® has an application-oriented exam and we strongly recommend anyone considering the OLC® look at working through many of the key concept explanations and exam-level questions that we offer as the exam is known to be quite challenging.

Personal Financial Services Advice® (PFSA®) Course Preparation Study Notes

The Personal Financial Services Advice (PFSA®) course, one of the courses required to obtain the PFP, was created to strengthen your confidence and knowledge so that you can advise your financial services prospects and clients based on their individual needs and goals. The PFSA® escalates your communications skills and helps you build stronger and profitable client relationships and confidence in your ability to professionally advise them. PFP (Personal Financial Planner): The banking industry’s equivalent of CFP. To earn this designation, administered by the Institute of Canadian Bankers (ICB), bank/financial institution employees must complete a financial planning educational program and have a minimum of six months’ work experience.

Wealth Management Essentials® (WME®) and Wealth Management Financial Planner Supplement® Exam Preparation

The Wealth Management Essentials® Course (WME®), as offered by the Canadian Securities Institute (CSI) focuses on two critical elements of wealth management - Financial planning and Investment management. Successful completion of the WME® course fulfils IIROC's 30-month requirement for maintaining your securities license. It is also one very important step towards qualifying to write the Certified Financial Planner® (CFP®) exam. Our study materials are designed to help you pass the WME® exams, and do not constitute enrolment in the actual Wealth Management Essentials® Course itself.

Conduct and Practices Handbook® Exam (CPH®)

The Conduct and Practices Handbook (CPH®) is a guide to understanding the rules, regulations, practices and ethics that will guide a career as an investment advisor or representative. Assists in meeting IIROC's proficiency requirements for licensing. Improves employability by gaining the education employers and regulators require.

Other Than Life (OTL®)

OTL® - Other Than Life license = Insurance Agent ..... RIBO® Registered Insurance Broker Ontario license = Broker.

Exams and licensing from: http://www.insuranceinstitute.ca/en/insurance-education/licensing/brokers-agents/Ontario - Agent Licence.aspx

Regulated by the Financial Services Commission of Ontario (FSCO), this licence is applicable to those employed by direct-response insurers, dealing directly with the public. For this course, SeeWhy Learning does not offer a study guide, as the actual textbook from the Insurance Institute® is clear and concise. However, you will find that our exam preparation questions will focus your studies, prepare you for the actual exam, and reduce your study time. These tools are so effective, that they carry our “If you don’t pass, You don’t pay! Period.” money back guarantee.

Both the RIBO (Registered Insurance Brokers of Ontario) and OTL (Other Than Life) license allow you to sell home and auto insurance in Ontario, however the OTL qualifies you to be an Insurance Agent while the RIBO license qualifies you to be an Insurance Broker.

Please note that the purchase of SeeWhy Financial Learning's exam preparation materials does not constitute enrolment in the actual licensing course(s) or exam. Instead, our materials are designed to assist you in understanding the content of such courses. If you have not already done so, you must register with the applicable course provider in order to obtain their course materials and write the actual exam. Course provider for the CSC® is® is www.CSI.ca (CSI).